If maintaining a reserve is industry apply, an adjustment must be made to NWC to incorporate one. If this adjustment isn’t made, working capital might be overstated by the quantity of the reserve. It protects the customer by decreasing the purchase worth if the amount of working capital delivered at closing is less than agreed.

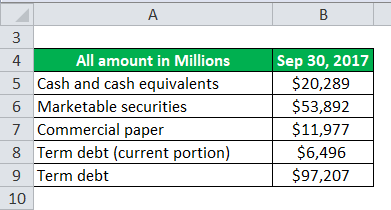

Companies will normally provide additional info on their money equivalents in the footnotes part of their financial stories. Net Debt is a metric used to measure the corporate’s monetary liquidity and assist in determining if the company can pay off its obligations by evaluating the liquid property with the whole debt. In simple words, it is the quantity of debt the corporate has compared to the liquid belongings and calculated as Debt minus money and money equivalents. Web debt is just the total debts of an organization subtracted from a company’s most liquid belongings. Basically, it offers analysts and buyers perception into whether an organization is under- or overleveraged.

Defining Which Payables Are Included

- The Board and the Basis encourage members and staff to precise their individual views.

- Understanding this will help the buyers decide whether or not they need to spend cash on the company’s stock or not.

- Working liabilities corresponding to accounts payable, deferred revenues, and accrued liabilities are all excluded from the web debt calculation.

- The Enterprise Value of a enterprise is the identical as its fairness value plus its web debt.

- In an inflationary surroundings, it is a contra-inventory account and reduces the worth of stock.

Once More, the adjusted web asset method can be used for varied valuations, corresponding to liquidations. This technique may also be helpful when valuing holding firms or those operating in capital-intensive industries. Different such instances when the adjusted net asset technique is useful is when valuations primarily based on income or money circulate are decrease than the adjusted net asset worth.

How Does The Goal Protect The Parties?

The commonest approach to valuing accounts receivable is to determine the receivables web of a common reserve for doubtful accounts. But, it’s important to know on what basis the reserve was calculated so it can be up to date for modifications in the enterprise. For example, if the reserve is calculated primarily based on a share of complete accounts receivable or revenue, it ought to be increased as the value of accounts receivable or revenue will increase. Reserves can either be basic, the place they apply to all accounts receivable, or particular, where they apply to a single account receivable, corresponding to one that’s slow-paying or otherwise in bother. Working capital fluctuates for many businesses throughout the year and can also be subject to manipulation.

Properly calculating NWC is important in M&A transactions because the acquirer must make sure the target enterprise has a sufficient quantity of working capital to proceed to operate after closing. An inadequate quantity would require the client to inject extra money into the enterprise, which increases the effective buy price and reduces their return on investment. To forestall this, the acquisition price in practically all middle-market acquisitions features a set amount of working capital, often recognized as a web working capital target, or peg for short. In sure instances, it could be tough to assemble an accurate business valuation using market or income-based approaches.

Importance Of Web Debt In Monetary Analysis

The longer this new norm is maintained, the extra likely the client will settle for it. As a vendor https://www.personal-accounting.org/, every greenback you reduce the working capital before closing effectively goes into your pocket at the closing table. The following is a sample calculation for a seasonal business with a busy interval from Might to August.

Sure, Web Debt is a flexible metric used throughout numerous industries to evaluate monetary leverage and liquidity. CFI is the worldwide institution behind the monetary modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anybody to be an excellent monetary analyst and have a fantastic career path. In order that can assist you advance your career, CFI has compiled many resources to help adjusted net debt definition you alongside the trail.

In M&A, buyers and sellers comply with a selected or set amount of working capital to be included within the buy price. This is called a target or “peg.” For instance, a $50 million buy worth could embrace $5 million in working capital. If the quantity of working capital delivered at closing is then calculated to be $4 million, the seller owes the customer $1 million through a purchase order value adjustment, or working capital adjustment. In most M&A transactions, the target is acquired on a cash-free, debt-free foundation. This means the vendor keeps the money however is responsible for paying off any debt at closing.

Any change in accounting practices might considerably have an effect on the NWC calculation. For sellers, aggressively accumulating receivables is an opportunity to comprehend additional value. If inventory is counted on a perpetual system, the calculation may be rolled forward from the last bodily rely. In most circumstances, the client will diligence the accuracy of the perpetual system to accept this technique.

Matching a company’s debt to its money circulate is critical when investors and creditors seek to weigh the probability of a company defaulting (i.e., unable to repay ongoing obligations as agreed). The adjusted internet asset methodology would include tangible and intangible property in the course of the adjustment process. Also included are off-balance sheet (OBS) belongings and unrecorded liabilities, similar to leases or different notable commitments. An IAS 7 reconciliation is totally different from a net debt reconciliation as a end result of it reconciles only actions in liabilities arising from financing activities and not movements in a internet stability. Examples include accrued employee expenses, corresponding to trip, paid time off, bonuses and other benefits, and utilities. Most smaller businesses don’t properly accrue expenses on their steadiness sheets, but it’s sensible to take action constantly before you start the sales process.

And the vendor will obtain a higher purchase price, by way of a purchase value adjustment, in the occasion that they deliver working capital above the goal. It means they can agree on how a lot working capital might be included in the purchase worth without having to fret if the actual quantity will vary between signing the LOI and the time limit. A working capital adjustment prevents it from being manipulated earlier than then, and assures the customer that sufficient capital will remain in the enterprise to take care of operations. Working capital changes are crucial in situations during which working capital is topic to vary earlier than closing. Metrics corresponding to days gross sales outstanding (DSO), days payables excellent (DPO), and days stock excellent (DIO) flesh out a company’s money conversion cycle.